Sovereign Wealth Funds Opt for Internet and Software Industries over Semiconductors

Posted on 05/21/2021

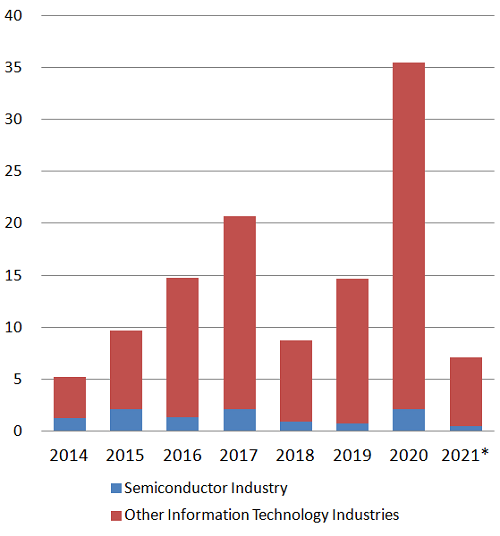

Direct Investment in the IT Sector by Sovereign Wealth Funds in Billion USD

Source: SWFI.com. BuyerType: Sovereign Wealth Fund. Excludes fund commitments.

In a computerized world, computer chips, or semiconductors, powers everything from cars, smartphones, and laptops. The recent shortage in chips and semiconductors have impacted prices in a wide range of U.S. consumer products. For example, The Volvo Group expects that have a negative impact on its earnings and cash flow due to chip shortage issues.

Sovereign wealth funds have been steady investors in the semiconductor industry, but in recent years have opted for higher growth industries in the IT sector such as software, data storage, and internet services. Sovereign investors differ from many other investors in their mandate, risk tolerance, priorities, and time horizons. Some wealth funds historically have taken a direct approach such as Mubadala Investment Company and its adventures with GlobalFoundries Inc. In 2020, SWFs directly invested US$ 2.147 billion in the semiconductor industry vs. US$ 782 million in 2019.

| Year | Semiconductor Industry as a Percent of Total Direct IT Investments |

|---|---|

| 2014 | 24.9% |

| 2015 | 21.8% |

| 2016 | 9.3% |

| 2017 | 10.2% |

| 2018 | 10.0% |

| 2019 | 5.4% |

| 2020 | 6.0% |

| 2021* | 6.5% |

Source: SWFI.com. BuyerType: Sovereign Wealth Fund. Excludes fund commitments.

The Outsourcing of the Real Silicon Valley

Many American firms do not own or operate their own fabrication facilities and contract with foreign firms located overseas to manufacture their designs. Fabrication facilities are located in countries such as Taiwan, South Korea, Japan, and increasingly in China. By 2019, Taiwan, South Korea, and Japan accounted for two-thirds of the world’s semiconductor fabrication capacity, and China for 12% of global fabrication. The U.S. accounted for 11% of the capacity in 2019 vs. around 40% in 1990.