SWFI Products and Services

Providing must-have intelligence and content on global institutional investors

Get a SWFI DemoSWFI Subscription

Enhance your capabilities

With a SWFI Subscription you'll gain valuable insights into developments, trends, movers and shakers, and risks in the Sovereign Wealth Fund and Institutional Investor space.

- Works on desktops, laptops, tablets, and smart phones

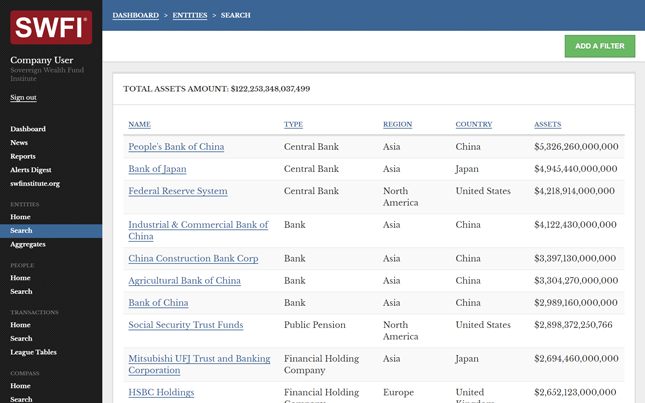

- Gain actionable insight into Executives and Key People, Investor Profiles, Transactions, Mandates and RFPs, and Flow Data

- Global library of transaction data and time-series financials and allocation data

- Identify entities and conduct (know your client) KYC research

- VIP briefings and news stories relevant to the world of asset owners

- User customized daily email alerts

- Unlimited licenses

- All users receive Sovereign Wealth Quarterly, surveys, and special reports

Profiles

Transactions

RFPs

News Articles

People & Contacts

SWFI Membership

Expand your reach, network, and promote your organization

The SWFI Membership is open to private and public entities. The global membership program provides a variety of marketing, outreach, and networking outlets for your organization to build meaningful relationships and exchange knowledge and best practices.

- Industry awareness

- Event participation

- Executive networking

- Sponsored posts and native advertising

- Whitepapers

- Advertising discounts

- Advertisements in Sovereign Wealth Quarterly

- Webinars

- Public Fund Monitor

SWFI Public Fund Monitor

A free daily publication of news around the institutional space

The Public Fund Monitor is a daily newsletter of roundup breaking articles and news. It's free to join.

Select SWFI Members

Sovereign Wealth Quarterly

Access 38 Quarterly Reports

The Sovereign Wealth Quarterly covers topics like asset management, external managers, asset allocation, investment tactics and strategies, and more.

Learn more about SWF QuarterlySWFI Datafeeds & API Access

Integrate SWFI data via RESTful web API's or CSV data feeds

The SWFI datafeed or API services provide you direct access to data as an add-on service to the SWFI Subscription. The data service is perfect for organizations wanting custom reporting or "to the minute updates" on updates and new records.

SWFI offers a standard REST API and can provide customizations as you see fit and can create custom webhooks for your applications.

Reasons why organizations use datafeeds and the API:

- Organize, store and maniupulate data in easy formats like

JSONorCSV - Custom data structures to match your organizations database architecture

- Dive deeper into insights and provide "white-labeled" reporting for your users

- You can dictate frequency and volume as you see fit

[

{

"_id": "65b930c1318c90edd7a1a926",

"actual": true,

"assets": 1648082769953,

"assetsNative": 16782681000000,

"carriedOver": true,

"cashDepositsAndShortTerm": 0.000511479661682183,

"cashGeneral": "",

"cashTotal": 0.000511479661682183,

"currency": "NOK",

"entityID": "598cdaa60124e9fd2d05b9af",

"equity": "",

"equityNative": "",

"fixedIncomeAssetBackedSecurities": 0.0168689376864161,

"fixedIncomeCorporateBond": 0.0597215665363597,

"fixedIncomeDevelopedMarket": "",

"fixedIncomeEmergingMarket": "",

"fixedIncomeGeneral": "",

"fixedIncomeGovernmentBond": 0.17886254287977,

"fixedIncomeInflationProtectedSecurities": 0.0168707848287172,

"fixedIncomeInternational": "",

"fixedIncomeRealEstateDebt": "",

"fixedIncomeRealReturnBonds": "",

"fixedIncomeRoyalties": "",

"fixedIncomeTotal": 0.27232383193126297,

"fixedIncomeUS": "",

"hedgeFundsGeneral": "",

"hedgeFundsTotal": 0,

"infrastructureAirports": "",

"infrastructureGeneral": "",

"infrastructureOilGas": "",

"infrastructureRenewableEnergy": 0.0010482830484593,

"infrastructureSocial": "",

"infrastructureTotal": 0.0010482830484593,

"infrastructureTransportation": "",

"insertedAt": "2024-01-30T17:24:17.343Z",

"insertedBy": "596014a3757068600923e322",

"investments": 1548145071000,

"investmentsNative": 15765000000000,

"liabilities": "",

"liabilitiesNative": "",

"naturalResourcesFarmland": "",

"naturalResourcesGeneral": "",

"naturalResourcesGold": "",

"naturalResourcesMasterLimitedPartnerships": "",

"naturalResourcesMining": "",

"naturalResourcesTimberland": "",

"naturalResourcesTotal": 0,

"netAssets": "",

"netAssetsNative": "",

"netInvestments": "",

"netInvestmentsNative": "",

"notes": "<p>Asset Allocation by Assets. Mixed RE = Corporate land.</p>",

"otherCryptocurrency": "",

"otherCurrencyOverlay": "",

"otherGeneral": 0.0422332246558221,

"otherInsurance": "",

"otherTotal": 0.0422332246558221,

"period": "2024-01-15T00:00:00.000Z",

"privateCreditDirectLending": "",

"privateCreditDistressedDebt": "",

"privateCreditGeneral": "",

"privateCreditLoans": "",

"privateCreditSpecial": "",

"privateCreditTotal": 0,

"privateEquityBuyout": "",

"privateEquityDirect": "",

"privateEquityGeneral": "",

"privateEquityGrowth": "",

"privateEquitySecondary": "",

"privateEquityTotal": 0,

"privateEquityVentureCapital": "",

"publicEquityAsia": "",

"publicEquityAustralia": "",

"publicEquityChina": 0.0206404538702726,

"publicEquityDevelopedMarket": 0.185098263739864,

"publicEquityEmerging": 0.0472732975738501,

"publicEquityEurope": "",

"publicEquityGeneral": "",

"publicEquityGlobal": "",

"publicEquityInternational": "",

"publicEquityJapan": 0.0479391186664395,

"publicEquityLatinAmerica": "",

"publicEquityNordic": "",

"publicEquityTotal": 0.666486913682028,

"publicEquityUK": 0.0406150866479557,

"publicEquityUS": 0.324920693183646,

"realEstateCorporate": 0.00047799275932135,

"realEstateGeneral": 0.000124950238880188,

"realEstateHotels": "",

"realEstateInvestmentTrust": "",

"realEstateLand": "",

"realEstateLogistics": 0.00639856051604627,

"realEstateOffice": 0.0089546479492758,

"realEstateResidential": "",

"realEstateRetail": 0.00195159521890454,

"realEstateTotal": 0.017907746682428147,

"updatedBy": "596014a3757068600923e322",

"updatedAt": "2024-03-02T00:44:29.175Z"

},

{

"_id": "65b930c1318c90edd7a1a925",

"entityID": "598cdaa60124e9fd2d05b9af",

"currency": "NOK",

"period": "2023-12-31T00:00:00.000Z",

"actual": true,

"carriedOver": "",

"netAssets": "",

"netAssetsNative": "",

"assets": 1648082769953,

"assetsNative": 16782681000000,

"equity": "",

"equityNative": "",

"investments": 1548145071000,

"investmentsNative": 15765000000000,

"netInvestments": "",

"netInvestmentsNative": "",

"liabilities": "",

"liabilitiesNative": "",

"notes": "<p>Asset Allocation by Assets. Mixed RE = Corporate land.</p>",

"publicEquityInternational": "",

"publicEquityGlobal": "",

"publicEquityUS": 0.324920693183646,

"publicEquityUK": 0.0406150866479557,

"publicEquityEurope": "",

"publicEquityNordic": "",

"publicEquityAsia": "",

"publicEquityJapan": 0.0479391186664395,

"publicEquityChina": 0.0206404538702726,

"publicEquityLatinAmerica": "",

"publicEquityAustralia": "",

"publicEquityDevelopedMarket": 0.185098263739864,

"publicEquityEmerging": 0.0472732975738501,

"publicEquityGeneral": "",

"publicEquityTotal": 0.666486913682028,

"fixedIncomeUS": "",

"fixedIncomeInternational": "",

"fixedIncomeInflationProtectedSecurities": 0.0168707848287172,

"fixedIncomeRoyalties": "",

"fixedIncomeGovernmentBond": 0.17886254287977,

"fixedIncomeEmergingMarket": "",

"fixedIncomeDevelopedMarket": "",

"fixedIncomeRealReturnBonds": "",

"fixedIncomeAssetBackedSecurities": 0.0168689376864161,

"fixedIncomeRealEstateDebt": "",

"fixedIncomeGeneral": "",

"fixedIncomeTotal": 0.27232383193126297,

"fixedIncomeCorporateBond": 0.0597215665363597,

"realEstateGeneral": 0.000124950238880188,

"realEstateTotal": 0.017907746682428147,

"realEstateOffice": 0.0089546479492758,

"realEstateResidential": "",

"realEstateRetail": 0.00195159521890454,

"realEstateLogistics": 0.00639856051604627,

"realEstateHotels": "",

"realEstateLand": "",

"realEstateInvestmentTrust": "",

"realEstateCorporate": 0.00047799275932135,

"privateEquityBuyout": "",

"privateEquitySecondary": "",

"privateEquityVentureCapital": "",

"privateEquityGrowth": "",

"privateEquityDirect": "",

"privateEquityGeneral": "",

"privateEquityTotal": 0,

"naturalResourcesTimberland": "",

"naturalResourcesFarmland": "",

"naturalResourcesMining": "",

"naturalResourcesGeneral": "",

"naturalResourcesTotal": 0,

"naturalResourcesGold": "",

"naturalResourcesMasterLimitedPartnerships": "",

"privateCreditDirectLending": "",

"privateCreditDistressedDebt": "",

"privateCreditSpecial": "",

"privateCreditGeneral": "",

"privateCreditTotal": 0,

"privateCreditLoans": "",

"hedgeFundsGeneral": "",

"hedgeFundsTotal": 0,

"infrastructureGeneral": "",

"infrastructureTotal": 0.0010482830484593,

"infrastructureTransportation": "",

"infrastructureSocial": "",

"infrastructureAirports": "",

"infrastructureRenewableEnergy": 0.0010482830484593,

"infrastructureOilGas": "",

"cashGeneral": "",

"cashDepositsAndShortTerm": 0.000511479661682183,

"cashTotal": 0.000511479661682183,

"otherInsurance": "",

"otherCurrencyOverlay": "",

"otherCryptocurrency": "",

"otherGeneral": 0.0422332246558221,

"otherTotal": 0.0422332246558221,

"insertedAt": "2024-01-30T17:24:17.343Z",

"insertedBy": "596014a3757068600923e322",

"updatedAt": "2024-03-02T00:44:29.175Z",

"updatedBy": "596014a3757068600923e322"

}

]

SWFI Consulting

Work with SWFI on special projects

No matter how large or small, SWFI has helped dozens of institutional investors, banks, and other organizations on a variety of projects.

- Sovereign Wealth Fund and Asset Owner Consulting

- Bespoke Research and Custom Surveys

- Due Diligence

- Investor Targeting

- Investment Consulting Services

- Asset Manager Services