Wealthy US Endowments Could in the Future Have Growing Tax Liabilities

Posted on 07/10/2020

As the United States grapples with COVID-19, students of universities are paying tuition, while not getting the full benefit of attending classes and even graduations. In American history, colleges and universities by their nature have a left-wing bias in their political ideologies – some majors more than others. In the past decade, there are mounds of evidence that some of the most prominent private colleges espouse these views and encourage political activity. In addition, many of these Ivy league institutions sit on tens of billions of worth of assets, generating investment income tax-free. As students struggle with student loans, many policymakers have wealthy endowments in their crosshairs as possible sources of taxable revenue. This could impact the investment portfolio of large endowments, if they are required to pay taxes on investment income, or revenue generated from tuition.

From an investment standpoint, these would deeply impact the asset allocation of mega college endowments as they are major investors in illiquid assets such as private equity funds, venture funds, hedge funds, timber funds, and real estate funds.

Prominent conservative figures like Will Chamberlain, Editor of Human Events, have called for a re-examination of college endowments in America. During the COVID-19 crisis, some of these schools laid off employees, while resting on cash-rich endowments. Chamberlain in his March 2020 piece called “Seize the Endowments” says, “If universities feel no obligation to care about the economic health of the broader community, it’s time for the broader community—and for conservatives in particular—to stop caring about the fiscal condition of the universities.”

Others argue that endowment funds are tied up and must used accordingly to donor wishes.

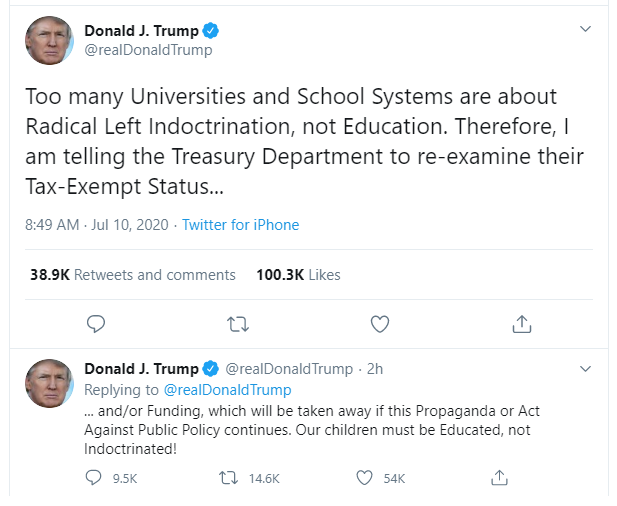

U.S. President Trump requested the United States Department of the Treasury to review the tax-exempt status of universities and school systems over “Radical Left Indoctrination, not Education.”

It is no secret, since Trump’s ascendancy to the Presidency, the culture war in America has heightened. Marxists, anarchists, and ANTIFA groups are taking down statues of historical U.S. figures including George Washington, Abraham Lincoln, Catholic leaders (Junípero Serra), as well as military figures who served in the Confederacy. City mayors are being pressured to take down statutes of past historical figures, corporate CEOs are renaming brands, while country music groups are changing names – from Dixie Chicks to Chicks and Lady Antebellum to Lady A. From an institutional investor viewpoint, investors will have to be more keenly aware of the zeitgeist when making investment decisions. In June, Princeton University agreed to remove the name of U.S. President Woodrow Wilson from its school of public policy and a residential college. Is Yale next for a name change – after all, it was renamed in 1718 after a slave trader – Elihu Yale?

Keywords: Yale Investment Office, Harvard Management Company.