What Can Institutional Investors Expect from a Trump Win?

Posted on 11/10/2016

The 30-year plus proliferation of globalism for now has taken a backseat. Due to intense reader interest by our internal analytics, I felt that I needed to write about the outcome of the U.S. election.

Many wealthy, business, and politically-powerful individuals (a majority residing in urban enclaves) in the U.S. have tremendously benefitted from globalist policies, while people residing in rural and smaller suburban areas in the country have not partaken or shared nearly as much in financial prosperity. Quantitative easing (QE) policies enacted by the U.S. Federal Reserve benefitted U.S. stock markets (wealthy people tend to hold large retirement accounts holding stocks), not small-time savers. The results were shown on November 8, 2016 (see electoral map via New York Times).

Centrism and moderates are on their way out, as voters, consciously or not, become impatient with the status quo.

In an internal summary I shared with some staff back in May 2016, after looking at populist sentiment and polling data, I had concluded before the conventions that Trump would barely win based on the electoral map and the popularity of U.S. Senator Bernie Sanders in the northern states. Florida and Ohio were the main states. This is what I wrote, “I predict the presumptive U.S. Republican nominee Donald Trump will barely edge out Hillary Clinton in the U.S. election in a game of electoral chess.” Also to be fair, in that May summary, I was wrong on the outcome of the Brexit vote.

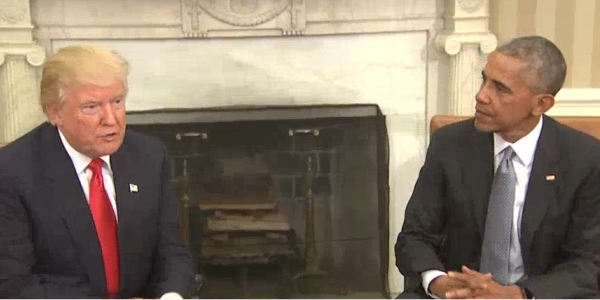

U.S. voters, through the electoral college system, have given U.S. President-elect Donald Trump a mandate. Centrism and moderates are on their way out, as voters, consciously or not, become impatient with the status quo. The Republican party now controls the Presidency, Senate and House of Representatives, a party reversal of when President Obama won in 2008. What does this mean for global institutional investors? The idea of a Trump victory is something a number of chief investment officers around the globe have chatted about. The election to them was a binomial event on a known date. By analyzing polling data and following wonks like Nate Silver, many U.S. media personalities believed Clinton would win. The analysis was faulty and the majority of T.V. pundits on the major networks did not have a solid understanding in basic statistics and sampling. Other issues in the faulty analysis are groupthink and the danger of echo chambers. This could be another story to pen.

Reform Candidates: Modi and Trump

Sovereign wealth funds and large pension investors, in cases when there are new parties in power, cautiously await the policy proposals of an incoming administration. One can look how India is now the darling of sovereign wealth fund and pension direct investment under Indian Prime Minister Narendra Modi. Modi was able to enact a series of reforms that attracted global institutional investor capital. According to data from SWFI’s transaction database, direct sovereign wealth fund and pension transactions remain resilient in India, while tapering off in other Asian markets. Trump is known as a builder and domestic spending will probably be a hallmark of his administration to create jobs and rebuild the country’s infrastructure. Will there be a U.S. infrastructure bank to lure sovereign wealth fund and pension money to help rebuild the crumbling infrastructure across America?

Discreetly, many CIOs believe a Trump win could signal a dramatic rise in the U.S. stock market, while having a negative effect on equities in emerging markets. However, this could be severely tapered if the Federal Reserve were to move aggressively on interest rates. While Hillary Clinton and Donald Trump were neck-and-neck in the early results on November 8, 2016, the Dow Jones Industrial Average (DJIA) futures took a precipitous fall. However, by 11:35 P.M. EST, when Trump was declared the winner of the state of Florida, it rocketed up. Many financial media talking heads and pundits (who were clearly wrong on the outcome of the election) said a Trump victory would be devastating for the stock market. On a November 1, 2016, interview with CNBC, Mark Cuban, Dallas Mavericks owner and reality T.V. star of Shark Tank, said that a Trump win would be the “worse for the market,” because he alleged Trump did not know when to talk. In contrast, Carl Icahn, a supporter of Donald Trump, quickly ran to the exits during the victory party to bet around US$ 1 billion on U.S. equities (confirmed in a telephone interview on Bloomberg TV.)

In the interview, he said, “The S&P was so liquid — it was unbelievably liquid — the world was going nuts. Last night it was amazing, the world was going into a panic with no reason.”

Hysterical reactions are opportune times to earn returns.

Winning Industries

Trump is inheriting a slowing U.S. economy mired in a world of negative interest rates. Second, this is the first time in U.S. history a real estate developer will be taking over the White House. Already U.S. listed equity investing in surging in some sectors, while declining in others.

Here are some data points from Park Alpha, the consulting division of SWFI.

| Sector / Industry | Asset | Benefit | Park Alpha General Reasoning |

|---|---|---|---|

| Pharmaceuticals | Listed Equities | Yes | GOP controls House and Senate, may get push back from Trump over regulations and limiting drug company profits in Medicare and other programs |

| Health Insurance | Listed Equities | No | Short-term pain over uncertainty regarding the replacement of the U.S. Affordable Care Act (Obamacare) |

| Construction | Listed Equities | Yes | Trump is keen on building all types of things, real estate and infrastructure. |

| Materials | Listed Equities | Yes | Raw materials could make a comeback, as the U.S. could generate a large amount of jobs (trade and infrastructure). |

| Solar and Wind | Listed Equities | No | Be prepared for a cut in subsidies |

| Tech Stocks | Listed Equities | No | Trade and manufacturing |

| Oil & Gas | Listed Equities | Yes | GOP-led, could see further incentives for areas in oil & gas |

| Aerospace | Listed Equities | Yes | Could see increases in orders, altering trade deals |

| Defense | Listed Equities | Yes | Typically rises when GOP controls both chambers |

| U.S. Offices | Real Estate | Yes | Could see economic growth |

| Hedge Funds | Hedge Funds | No | GOP vs. Trump on getting rid of carried interest for hedge funds. Most hedge fund executives supported Clinton over Trump. |

| Renewables | Private Equity | No | Under Trump, if it is not economically-feasible without subsidies, high-risk of failure. |

This is not investment advice. Please read the disclaimer.

The views in this article are expressed by Michael Maduell.

Michael Maduell is President of the SWFI.

www.swfinstitute.org