2015: Strong Start for Sovereign Wealth Fund Deals

Posted on 08/10/2015

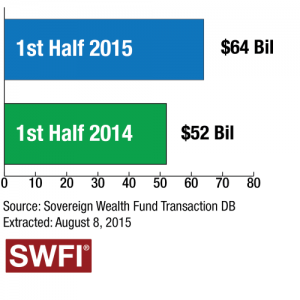

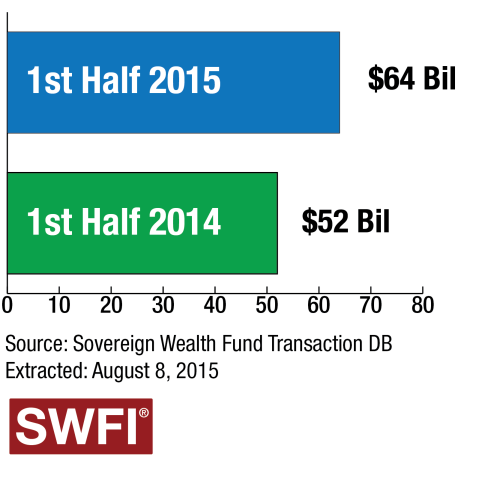

Direct Sovereign Wealth Fund Transactions

Despite a possible future slowdown in the global economy, direct sovereign wealth fund transactions for the first half of 2015 conquered the first half of 2014. According to the Sovereign Wealth Fund Transaction Database (SWFTD), wealth funds generated US$ 64 billion worth of deals in the first half of 2015 versus US$ 52 billion in the first half of 2014. While this trend is promising in regard to wealth funds acquiring more in the first half of 2014, SWFI recorded 910 observations versus 833 observations in the first half of 2015. These institutional investors became slightly more bullish in direct investing in developed markets in 2015. In Europe, the United Kingdom received the most wealth fund inflows of direct investment in the first half of 2015, some US$ 21.1 billion, trumping their peers. However, more sovereign investors embarked on investing in continental Europe real estate versus a strong preference toward London. In March 2015, ADIA and GIC invested in Unicredit-Piazza Cordusio in Milan. China paved the way for Asia for the first part of 2015, generating US$ 6.4 billion in direct sovereign fund transactions. A number of wealth funds participated as cornerstone investors in unique opportunities. The Modi effect has stimulated wealth fund investment in the sub-continent. Wealth funds like GIC, Temasek Holdings and the Abu Dhabi Investment Authority (ADIA) remain particularly active in the country. Deal amounts are far lower than their Eastern Asian and Western counterparts. Sovereign investors made deep strides into Indian real estate developments, technology companies and pharmaceuticals.

For deal flow, sovereign investors exerted influence on their positions as limited partners at name brand private equity firms.

Real Estate

Whereas over a two decades ago, these institutional investors heavily relied on commingled real estate funds, today wealth funds are competing against them in varied instances or taking on separate account programs. Real estate managers competing for core properties in markets fear that wealth funds and some Canadian pensions are fine with acquiring prices at unjustifiable cap rates. Sovereign wealth funds exhibited a greater preference toward direct real estate investing in the first half of 2015 at US$ 17.1 billion versus 1H 2014 at US$ 9.8 billion. A few notable deals in the first half of 2015 include the Investment Corporation of Dubai (ICD) picking up some hotels – notably the W Hotel in Washington, D.C. and the Mandarin Oriental in New York.

Sovereign Wealth Centers on Buyouts

For deal flow, sovereign investors exerted influence on their positions as limited partners at name brand private equity firms. Firms like the Blackstone Group, 3i and Thoma Bravo, consider sovereign funds to be helpful sources of capital when deals need an extra shot of financial juice. Total control of a target company tends to be an afterthought in most cases. In 2015, wealth fund investors participated in a number of large buyout deals. For instance, one deal is the May 2015 transaction of investing in the merged company merging O2 U.K. and Three U.K. called Hutchison 3G UK Holdings (CI) Ltd. This mega U.K. telecommunications deal attracted massive pension allocators like CPPIB and Caisse de dépôt et placement du Québec (CDPQ), but also two major sovereign funds – GIC and ADIA.

Big Funds Eye Change in Corporate Governance

With wealth funds controlling greater ownership percentages in companies, the topic of corporate governance has taken center stage at Norway’s Government Pension Fund Global (GPFG). Norway’s GPFG is managed by Norges Bank Investment Management (NBIM) which is a division of Norges Bank, the country’s central bank. NBIM is headed by Yngve Slyngstad, twice making it on the Public Investor 100 (2013 and 2014), is known as a philosopher or deep thinker by his colleagues and peers. As the GPFG owns greater proportions of listed companies, corporate governance is moving toward the driver’s seat. Many large public institutional investors outsource corporate governance to proxy firms like ISS. NBIM is embracing a different approach, taking the first step of revealing their voting intentions at annual meetings (showing the vote results post-meeting.) NBIM plans to give the corporate world a more convenient heads up by issuing a series of position papers to clarify their stances. In an interview with the Financial Times in early August, Slyngstad made it clear “that he does not want investors to usurp the traditional role of the board.”

Keywords: GIC Private Limited, Norway Government Pension Fund Global.

- Abu Dhabi Investment Authority

- cdpq

- CPPIB

- Deals

- Government of Singapore Investment Corporation

- Investment Corporation of Dubai

- Norway Government Pension Fund Global

- Real Estate

- Sovereign Wealth Funds

- Temasek Holdings